Marine insurance digital transformation: six key benefits for practitioners

Digitalisation has been a dominant topic in marine insurance. The need to transform underperforming businesses has led to initiatives such as the Decile 10, as well as two Blueprints outlining Lloyd’s digital future. For many, the global pandemic and shift to remote working has added further pressure, accelerating the roll out of new digital infrastructure.

Our Beyond Covid: The Marine Insurance Business Resilience Blueprint includes commentary from Jonathan Humm, class underwriter at AEGIS London, Marcus Broome, Chief Platform Officer at Whitespace, marine insurance veteran Simon Stonehouse, Patrizia Kern, Chair of the IUMI Data and Digitalisation Forum and Mita Chavda, Head of Technical Sales at Concirrus on digital strategy.

Jonathan Humm, class underwriter at AEGIS London recently commented on the move to digital: ‘…the big challenge for the industry now is integrating the old way of working with the new.’

Many companies have debated what digitalisation means for them, and how will it impact their business. Here we highlight the benefits of digitalisation for the marine insurance community.

Digitisation versus digitalisation

Digitisation is the process of converting physical information into a digital format. Digitalisation leverages technology and digital resources to improve business processes, create new digital services and revenue streams.

How can digitalisation improve sustainability in marine insurance?

- Reduced costs

There are several ways digitalisation reduces costs. Lloyd’s Blueprint Two outlines a two-year change programme which aims to deliver a digital marketplace for future trade. Lloyd’s expects an £800m reduction in operating expenses as a result, with most savings coming from travel and entertainment.

Companies that leverage big data to improve segmentation and analysis will see their teams make more informed decisions around risk selection and pricing. New insights give perspective on profitable accounts which can aid prospecting. They can also be used to assess the pricing adequacy of unprofitable accounts and guide renewals. Such changes help mitigate risk and the resulting losses. - Increased efficiency

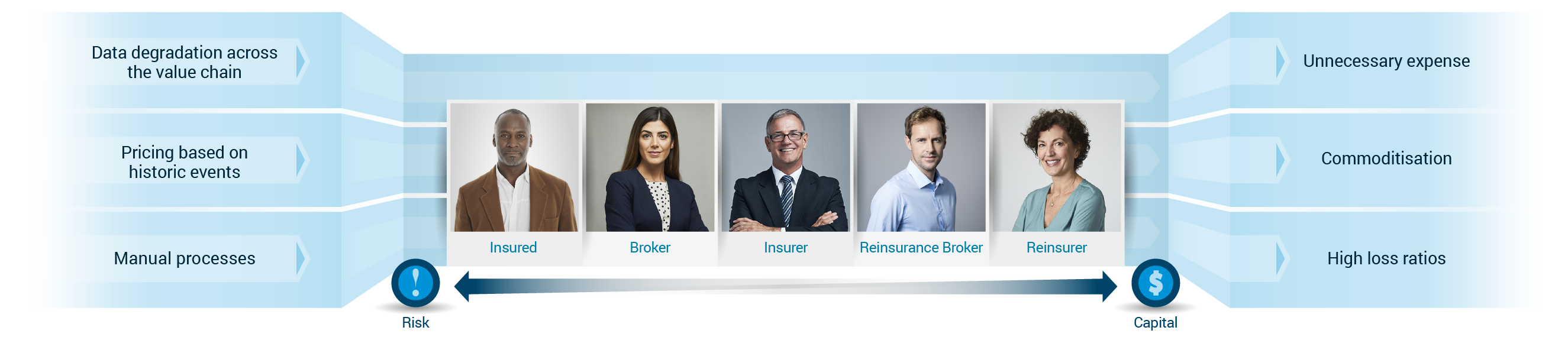

Traditionally, data has been passed along the insurance value chain illustrated below. The quality of data typically degrades through each transaction.

If everyone throughout the value chain had access to the same quality of data, they would share a single view of risk. This would allow the insurance market to more effectively place, price, and manage risk, leading to a more sustainable future.

Further efficiencies arise through removing the reliance on face-to-face meetings to place risk. Digitalisation can automate high volume, low value activities to ensure expertise is focused on more complex activities. Simon Stonehouse references the automotive insurance sector to illustrate other areas where this approach has delivered results.

- New products and services

By minimising repetitive low value activities teams can focus on complex risk and get back to creating new services, new revenue streams and innovative solutions.

Digitalisation offers the industry insights into the following questions:

Are their current offerings still fit for purpose?

Are there gaps in the coverage they offer to clients currently?

Are they losing market share?

In answering these questions, organisations can realign their products and services to meet the current and future needs of the market. Innovation can drive new products that provide better protection, more competitive pricing that better aligns to Insureds risk and services that focus on preventing losses rather than covering them.

- Patrizia Kern echoes this by saying, ‘Real-time assessment of risk is opening up huge opportunities for innovation in marine insurance.’

- Improved safetyThe real value of data and digitalization in insurance lies in understanding the root causes of claims. Advanced analysis helps uncover the underlying behaviours and conditions that correlate to claims. Such insight helps the market educate operators on the practices and environmental conditions that increase the likelihood of a claim. This directs changes in operating practices, reducing risk

By focusing on claims prevention, the industry can change the nature of the insurance community. Industry data, analytics and expertise could further proactive efforts to prevent loss, reducing the frequency and severity of claims over time.

- Stronger relationships

Many might expect that digitalisation spells the end of the human contact the industry has been founded on. However, by combining big data, automation and machine learning effectively with your team’s expertise you can actually strengthen ties with your clients. Rather than focusing on traditional annual transactions, you can work proactively to provide advice and support to reduce risk and avoid expensive claims. Respond quickly to their needs and offer valuable risk consultancy advice to help them improve their risk profile to benefit from more tailored premiums. - Environmental impact

It would be remiss of us not to call out the resulting environmental benefits of digitalisation. Most business has been historically transacted via paper. Covid-19 forced the industry to make the shift to remote working, making electronic documentation key to continuing to write risk and manage claims. The environmental savings, in addition to the cost savings within the industry, will have been significant.

More importantly, by switching the focus away from covering risk to preventing it the sector can help to reduce catastrophic maritime incidents. Active risk management and early intervention could prevent incidents such as the recent collision involving general cargo ships, HESEN M and CANSEL, or groundings such as the MV Wakashio in the south of Mauritius in July that had serious implications for the environment due to the resulting oil spill. This must be our shared vision for the future of a sustainable insurance market.

As new digital players are entering the market, unencumbered by legacy systems, it’s more important than ever for traditional insurance companies to take the next step on their digital transformation journey if they are to create more resilient businesses. In his closing comments Marcus Broome stated, “Successful digital strategies are those that are easy to use and that everyone within an organisation is engaged with, not just the transformation team. Such strategies can in practice realise significant cost savings, improve customer experiences and strengthen business resilience.”

To learn more download our blueprint below.

Powering the future of insurance

If you want to book a 1-1 meeting with us then let us know by clicking the link below.

Book a meeting